Housing Allowance Tool

How will the 2018 Tax Cuts and Jobs Act affect you? Sign up for a free membership to use this calculator and other free resources!

Ready to save on your taxes?

Schedule a one-on-one session with Scott Larsen now for a FREE review!

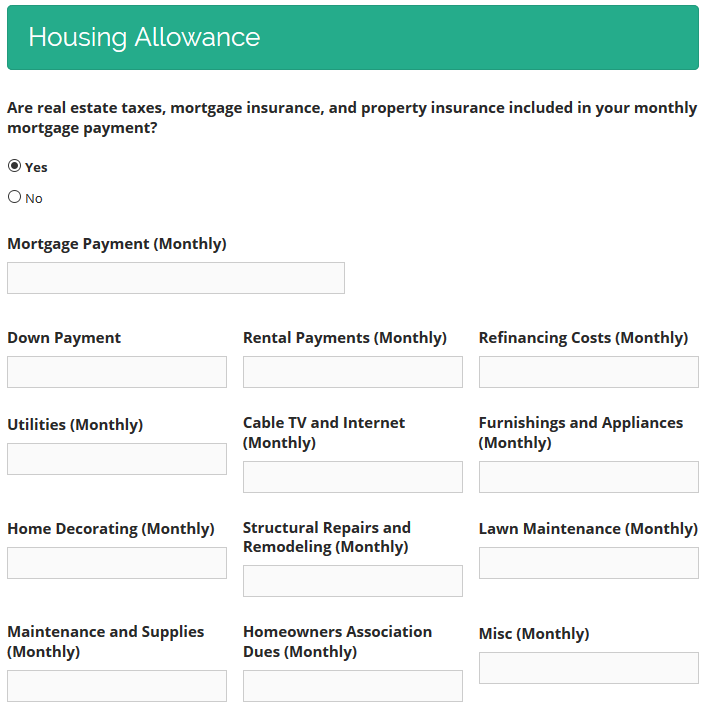

How will the 2018 Tax Cuts and Jobs Act affect you? Use this form to calculate your housing allowance!

Must be logged in!